Also in the letter:

■ Agilitas-Lotto deal

■ Layoffs at Good Glamm Group

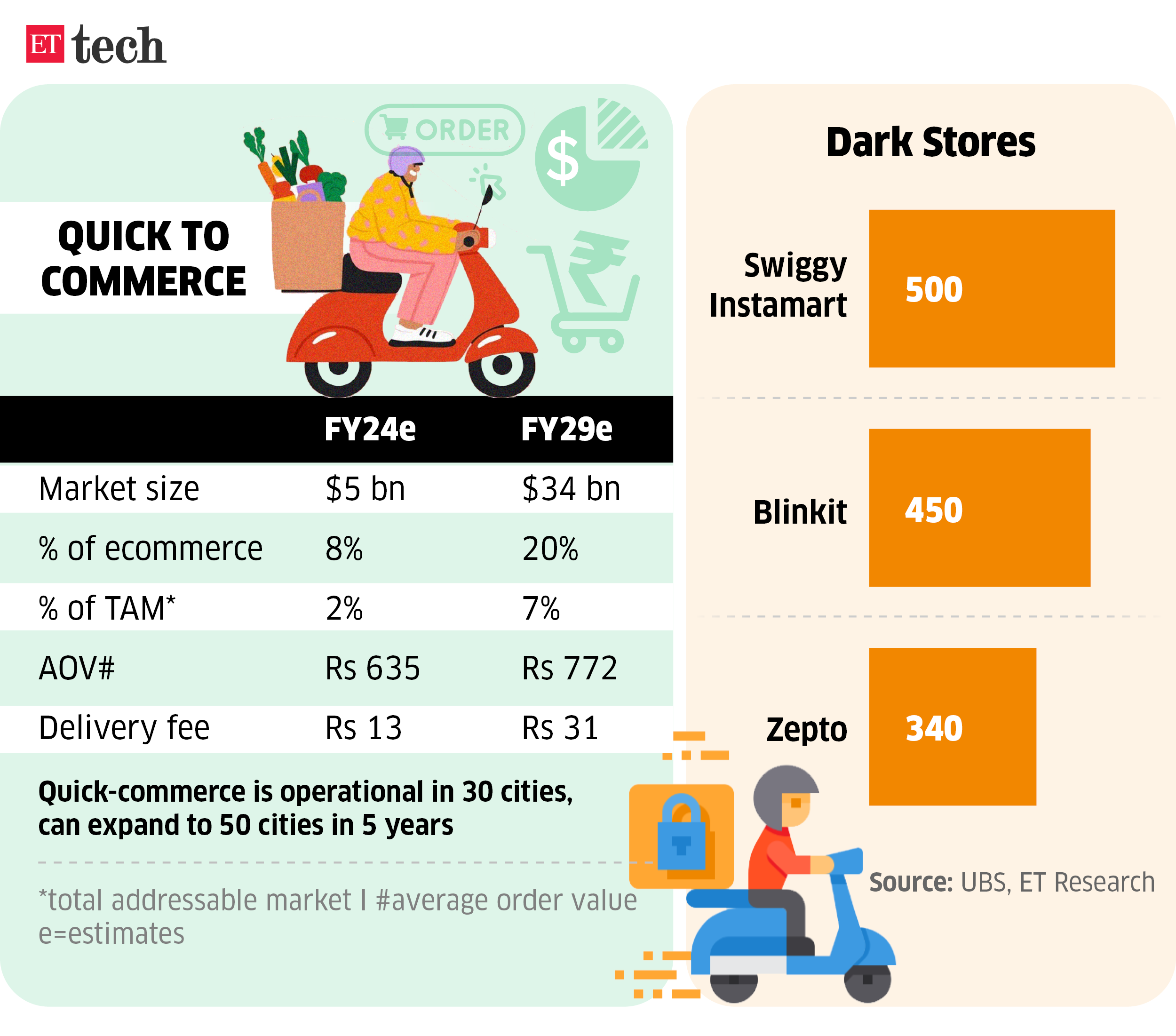

■ Swiggy integrates Mall with Instamart

Exclusive: Flipkart’s talks to buy majority stake in Zepto falter

Kalyan Krishnamurthy, CEO, Flipkart

Ecommerce major Flipkart made an offer to buy a majority stake in quick-commerce startup Zepto but the talks fell through. We have all the exclusive details.

Driving the news: Flipkart’s on the lookout for an acquisition to bulk up its quick commerce ambitions. After its failed discussions with cash-strapped Dunzo, the ecommerce major held talks with Zepto, according to two people in the know. But the talks have not materialised and unlikely to be revived, these people said.

Why does it matter? Despite the deal not going through, it underscores the importance of the sector and how it has been able to challenge the incumbent ecommerce players. Walmart-owned Flipkart will launch its own quick-delivery service in July.

Also read | Where is Flipkart’s long-in-the-making IPO?

Go deeper: Zepto, instead, is looking to close a funding round from financial investors. It is expected to have secured over $200 million in commitments from existing investors and former YC Continuity Fund chief Anu Hariharan’s new venture Avra. Sources said Zepto is in discussions with General Atlantic and Abu Dhabi Investment Authority (ADIA), along with others.

Zepto is essentially looking for an external investor to lead its new round of funding.

Also read | Zepto in talks for $300 million raise at $2.5-3 billion valuation

Financing round: As talks with Flipkart haven’t moved ahead. Zepto is likely to close a financial round valuing it at around $2.5 billion. That’s nearly double from its last round valuation last year.

Zepto has told investors it can stitch up a round of as much as $500 million which may include a secondary share sale. Glade Brook Capital, Nexus Venture Partners are among the existing investors who have offered cash commitments to Zepto.

Also read | Non-grocery items deliver bright growth to dark stores

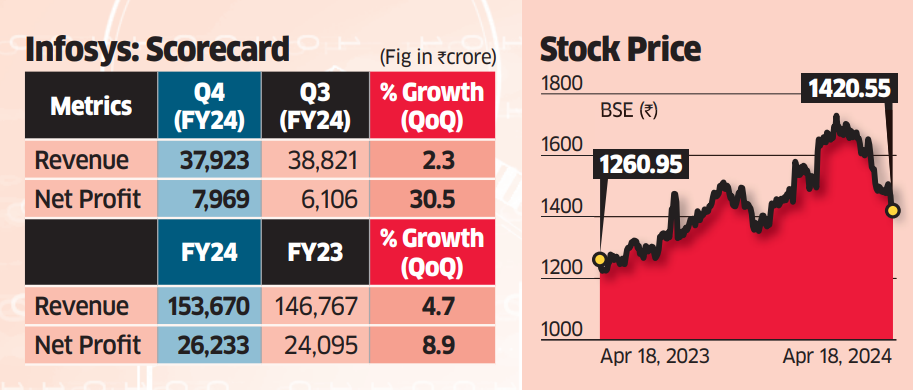

Infosys Q4 net profit up 30%; company buys German tech firm

Salil Parekh, CEO, Infosys

Infosys, India’s second-largest IT services company, Thursday said fourth-quarter net profit climbed 30% on year due to gains in non-core income.

Financial highlights:

- Profit climbed to Rs 7,969 crore in the March quarter

- Revenue at Rs 37,923 crore was up only 1.2% on a y-o-y basis

- Operating margin for the March quarter came in at 20.1%

- Headcount shrank by about 26,000 in FY24

Forward outlook: Infosys gave a FY25 revenue guidance of 1-3% even as it won “record deals” totalling $17.7 billion in FY24. Chief executive Salil Parekh said some of the gains from the deal wins have been baked into the revenue guidance. It expects operating margin to be in the range of 20-22%.

Parekh maintained a cautionary tone for the overall demand environment and said only verticals like banking and financial services are expected to be better in FY25 while others like manufacturing are expected to be slow.

Quote, unquote: Jayesh Sanghrajka, new CFO at Infosys who took over from April after the exit of Nilanjan Roy, said: “Consistent with the objective of giving high and predictable returns to shareholders, the board has approved the capital allocation policy under which the company expects to return 85% over the next 5 years and progressively increase annual dividend per share.”

Tell me more: Infosys on Thursday said it is acquiring in-tech, an engineering R&D services provider focused on the German automotive industry. The cost of the acquisition is pegged at $480 million (450 million euros).

Earnings from this buyout have not been included in the FY25 revenue guidance.

Pain points: North America continues to see negative growth for the company, while Europe is doing better in line with its industry peers. Infosys is seeing shrinkages in two revenue streams, financial services and retail, of 8.4% and 3%, respectively, in the number of clients.

Agilitas Sports acquires Lotto licence in India for 40 years

Sportswear and athleisure venture Agilitas Sports, cofounded by former Puma India head Abhishek Ganguly, has acquired Italian shoe brand Lotto’s India licence for a period of 40 years at an undisclosed price.

Deal details: Under the partnership struck with Lotto parent WHP Global, Bengaluru-based Agilitas will invest in a dedicated management team for the Lotto brand and handle the manufacturing, design and sale of its products across India, South Asia and Australia.

Tell me more: Indian shoemaker Mochiko, which Agilitas had acquired in September 2023, will make Lotto’s shoes for India and localise new designs. Mochiko’s Noida factory will be used to manufacture Lotto products, including footwear, apparel, accessories and sports equipment. Agilitas plans to open some 200 stores and is targeting a business of Rs 2,000 crore from the Indian market in the medium term.

Other Top Stories By Our Reporters

The Good Glamm Group lays off 150 employees: The Good Glamm Group has laid off 150 employees, or about 15% of its workforce. The content-to-commerce platform said it has put in place a new organisational framework to streamline operations, which led to eliminating certain redundancies over the last 15 months.

Swiggy integrates Mall offering with Instamart: Swiggy is integrating its Mall offering, where it was experimenting with the sale of non-grocery items like footwear, apparel, electronics and electric appliances, with its headline quick-commerce service Instamart.

Tata Comm dials up AI compute spends as Nvidia deal advances: Cloud infrastructure provider Tata Communications said that it is making significant investments in creating artificial intelligence compute capacity as it progresses on its deal with superchip maker Nvidia to build an AI supercomputer.

Global Picks We Are Reading

■ The real-time deepfake romance scams have arrived (Wired)

■ OpenAI’s model all but matches doctors in assessing eye problems (FT)

■ Bangladesh built a tech park for 100,000 workers. Now it’s a ghost town (Rest of World)